The money from your property taxes helps the volunteer fire station pay for the pumper truck racing down the road at midnight on its way to a burning house. The funds might go toward the stack of books you just checked out from your local library. And when your child gets off her school bus, know that the Arkansas property taxes you paid helped fund the education she received that day—and the transportation that brought her home.

Local Tax for Local Services

The most important thing for Arkansans to understand about their property tax is that it sticks close to home. The taxes on your 2015 Subaru Outback help fund the hospital you drive by on the way to work and the county road you take on the way to play.

The one exception to the local allocation of taxes is the 25 mill uniform property tax for schools. County governments collect that revenue and send it to the state. The state then distributes the money back to schools based on a funding formula for school districts that serve students in Kindergarten through 12th grade.

Photo credit: Wayne Miller/UofA Division of Agriculture

Wayne P. Miller is a professor with the University of Arkansas System Division of Agriculture. In cooperation with the research and extension department of the university, he publishes regular information about taxes in the state. He says there are still misconceptions that property taxes are sent to the federal government.

“In 1992, there was a movement to abolish the property tax because people thought the money collected went to Washington, D.C. Since then, more education has helped citizens realize their money funds local services in their jurisdiction and in their city. The Arkansas property tax is a local tax supporting local services.”

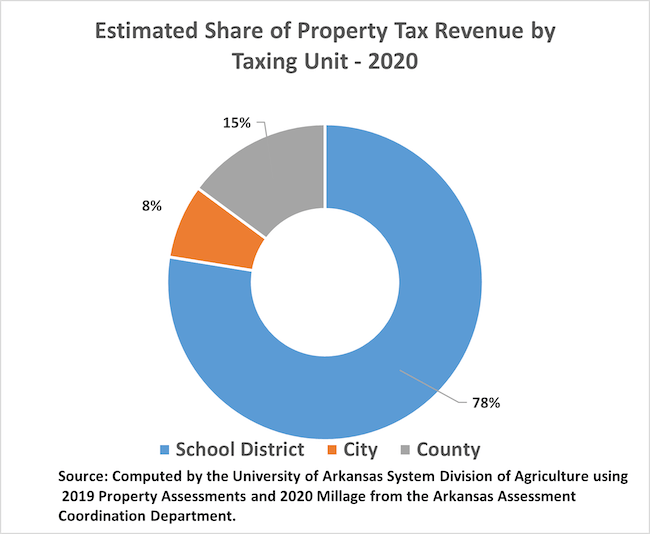

The service that most benefits is education; the largest percentage of property taxes where you live directly funds the schools in your area. The money contributes toward teacher salaries, equipment and building maintenance. During the 2020-2021 school year, property tax money might have been used to help support various needs to continue virtual school lessons for children during the pandemic.

Real Property

Real property, defined by Arkansas Code 26-1-101 includes owned real estate. This could be the lot your house sits on or the five acres of farmland your neighbor owns outside of town. Real property also includes land structures that sit on that land like houses, mobile homes and barns.

If you rent an apartment or house, you’re not exempt. Rest assured, your monthly rent includes the property tax your landlord is required to pay. Of course, neither are you exempt from receiving emergency medical services, help from law enforcement, or prevented from playing basketball at the neighborhood park. Those fall under the general operation of city and county governments that are partially financed by those Arkansas property taxes.

Personal Property

Personal property refers to tangible, movable property. Vehicles and livestock fall into this category, as do motorcycles and recreational vehicles. Yes, you’ll have to pay personal property tax on that boat you’re taking next weekend to your favorite Arkansas lake. As you enjoy a day filled with adventures on the water and a lot of grilled foods, remember that money helps fund the cleanup, safety services and recreational land available to you while you’re there.

Photo courtesy of Arkansas Department of Parks, Heritage and Tourism

Technically, taxable personal property also includes things like furniture and jewelry and appliances, but those kinds of items were exempted in 1992 with Amendment 71 of the Arkansas Constitution. In other words, you don’t need to report on the contents of your jewelry box or the value of your washing machine.

Property Taxes Across the State

To get more information about what your property taxes support, contact your county officials. Or you can take a look at the official county government websites.

In Garland County, collector Rebecca Dodd Talbert says that the majority of the money they collect goes to the school districts, with additional taxes going to the road department, county library and college. She adds that most of the county fire departments also receive their dues through tax collections.

On the Pulaski County Treasurer website, you can read about the services funded by your tax dollars including roads and bridges, jail and local government, and the children’s hospital. Rural Pulaski County residents can expect roughly 80% of their tax dollars to go to public school, almost 10% to jails and government, and close to 6% to roads. The numbers are slightly different for someone who lives in Wrightsville. Public schools get 73% of that money; county services 9% and roads are closer to 5%.

If you’re a resident of Washington County, you can see a detailed view of spending with information about the 2020 approved budget.

Resources for Arkansans In Any County

Remember that Arkansas property taxes are due October 15. At the University of Arkansas Division of Agriculture Cooperative Extension service website, you’ll find information about taxes and a whole lot of other available services, many of which are, of course, financed in part by the property taxes you’ll pay.